Consignor Commission on Renting Item

Through the feature of R2, the intention is to define the Consignor Commission Percentage through the Commission Group.

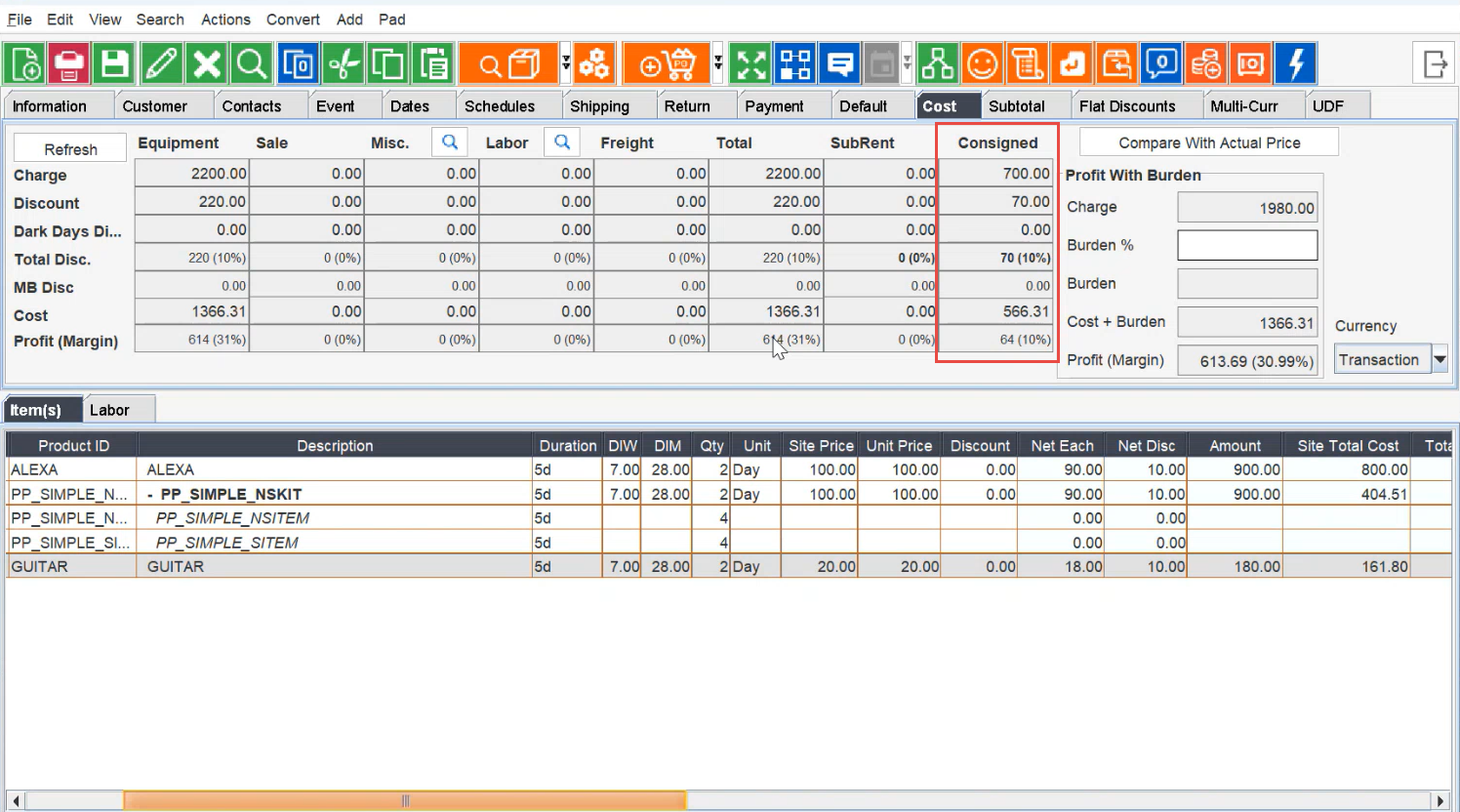

This way, anyone can see the Charge, Cost and Profit Margin of Consigned equipment separately in the Order > Cost tab. So, the person handling the Order can precisely make an estimate of the charges and profit margin to be put across on the Order to achieve the targeted Profit.

But before we dive into the concepts of Consignor Item Commission Percentage, let’s get some of the basics in place.

Read more about the concepts of Consignment, Consigner/Consignee, Consignment Cost, and Consignor commission here.

What is Consignor Commission?

The Consignor is the person who receives consignor commission amount percentage of the revenue from rental.

The item cost will be calculated on the percentage defined if the item is consigned.

If item is sub rented it will not be considered as consigned item even though it is marked as consigned.

How it works?

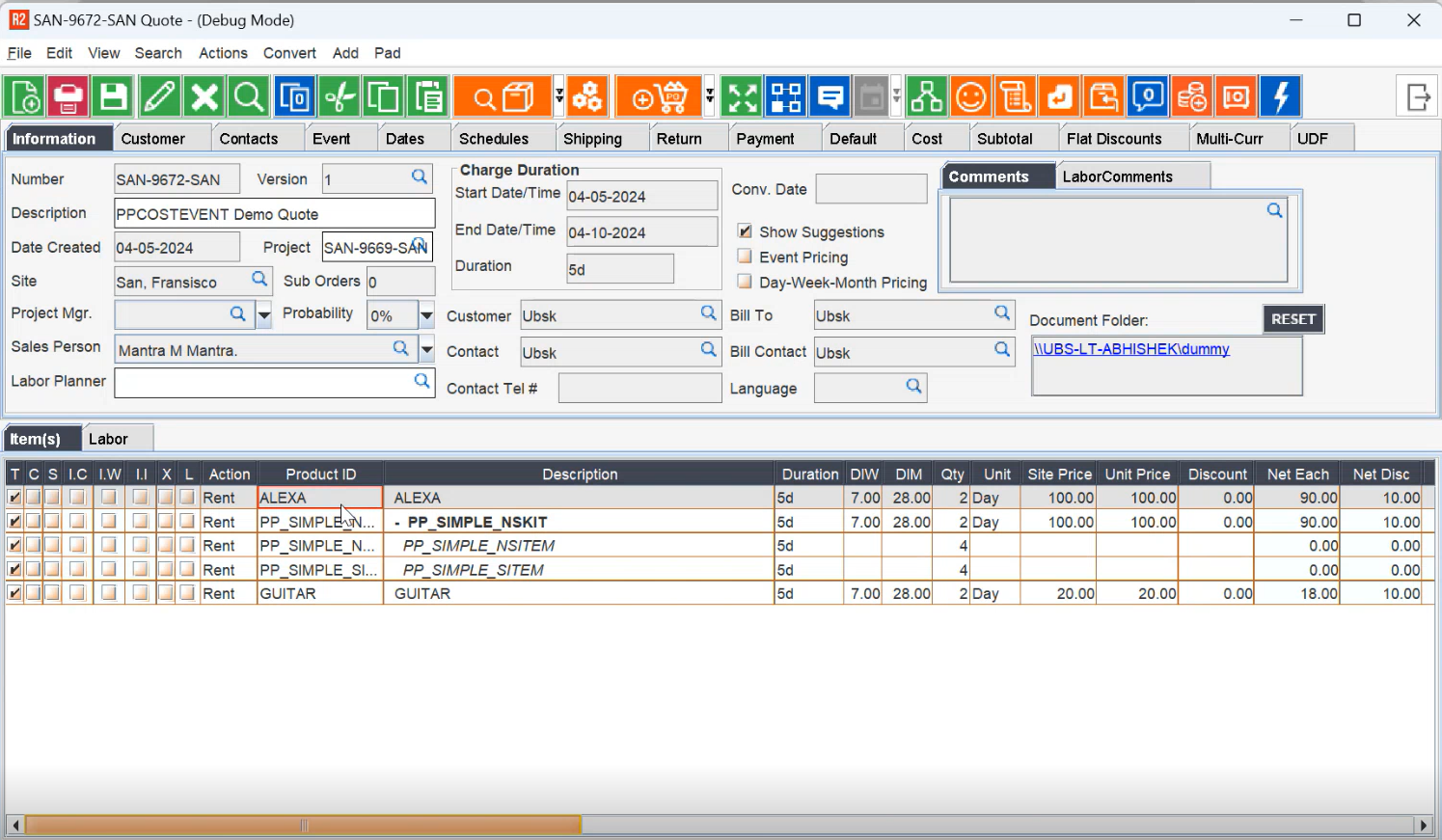

Create an order/event having normal item and consigned items. i.e., Alexa is normal item and Guitar is Consigned.

Example

Consider 2 Items “Alexa” = regular item and having quantity=2 and “Guitar” = consigned item having quantity=2.

Consider item Alexa having Amount=1000 and Guitar having Amount=200

Consigned Item “Guitar” cost and commission calculation:

Total Amount-Unit Cost=Profit margin

Items | Cost | Amount | Discount | Profit | Unit cost | Quantity | Duration |

|---|---|---|---|---|---|---|---|

ALEXA (Regular Item) | 800 | 1000 | 100 | 200 | 80 | 2 | 5 |

GUITAR (Consigned Item) | 179.78 | 200 | 20 | 20.22 | 17.97 | 2 | 5 |

Consigned cost table

Total | Consigned |

|---|---|

220.22 | 20.22 |

979.78 | 179.78 |

1200 | 200 |

18.35167 | 10.11 |

Consigned Item cost calculation table

Item | Amount | Commission | Cost |

|---|---|---|---|

Guitar | 200 | 89.89 | 179.78 |

You can also see the specific Consigned Items 'Total Cost' and 'Profit Margin %' in the Order Item grid, which is calculated as Amount x Consigned Commission %.

What are the rules?

The Consigned Item's Cost will be calculated as Percentage of Discounted Amount of the specific Item on the Order.

When a Consigned Item is Sub-rent, the Cost of it will be referred from the Purchase Order.

The Consigned Item Cost information in the two custom report views - Rep_ProfitMarginView and Rep_ProfitMarginDetailView.

For a Consigned Item either the Commission Group is not defined or if Commission % is not defined for the Commission group of a Consigned Item, commission considered will be 0%.

A Serial Kit or a Non-serial Kit cannot be marked as Consigned. Hence, if you define Consignment Commission % for a Commission Group of a Serial Kit, it will not be used.

If a Consigned Item is part of a Non-serial Kit, that particular Child Item's Cost will be calculated based on its Commission Group's Consignment Commission %.

If Item is marked as Consigned but not tagged under commission group, then it takes cost from Pricing Group

Cost of Non-serial Kit in R2 is always by sum of cost of individual child item.

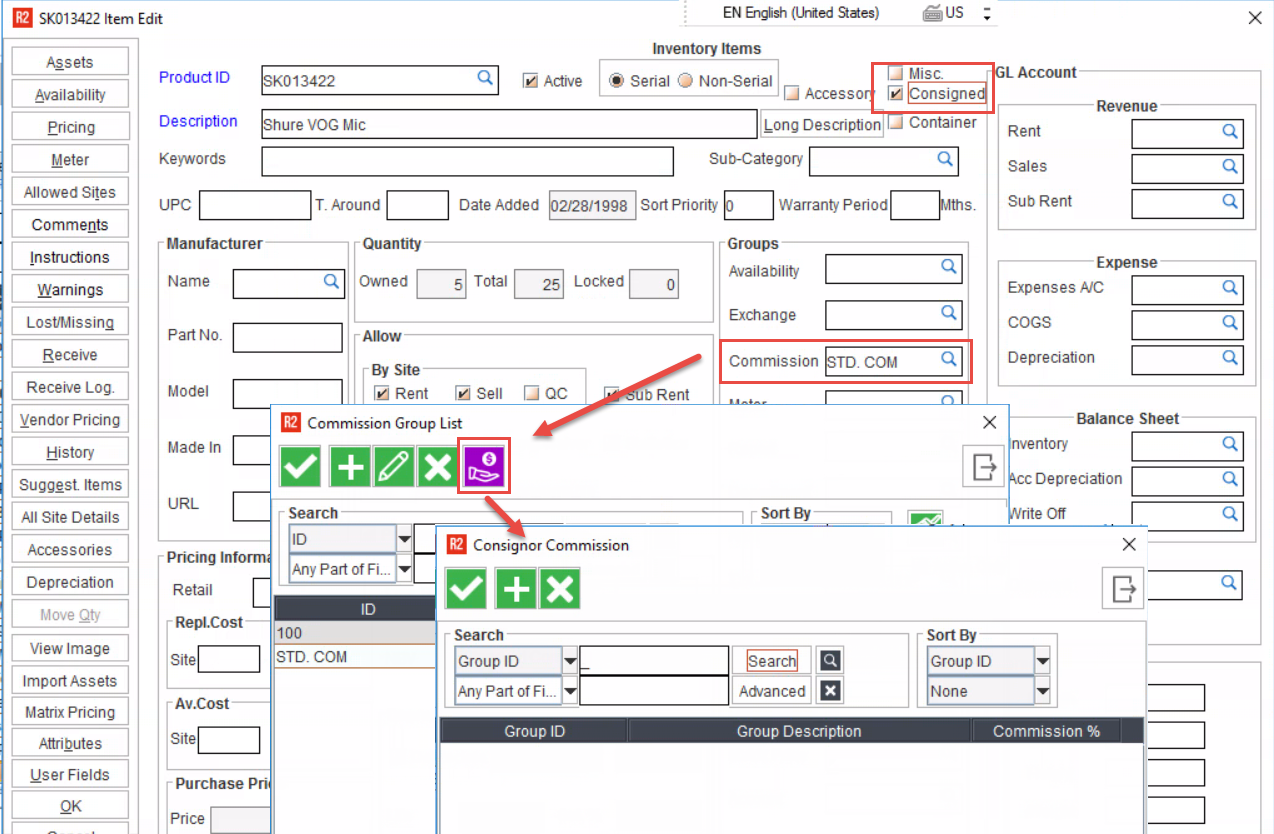

Defining Consignor commission

Defining a Consignor commission through Commission group window, here you can select any commission group and add, delete or edit commission group.

Consignor Commission group can be opened only from Item edit screen.

Go to Maintenance > Items > Select any item > Item edit screen will be opened

You can Add or Delete the consignor commission group Id’s from consignor commission list

You can search by ‘Group ID’ or ‘Description’ of an Commission group

Details of Consigned Item window

Field name | Description |

|---|---|

Group Id | This shows the ID of an Commission group to which the Consignor Commission belongs to. |

Group Description | Group describes the description of Commission Group selected |

Commission % | Commission percentage of selected commission group |

Displaying Consignor Commission in Order > Cost Grid

Click on Cost tab to check Consigned Item Cost and Profit margin.

Equipment Colum shows amount of both Consigned + Regular Items

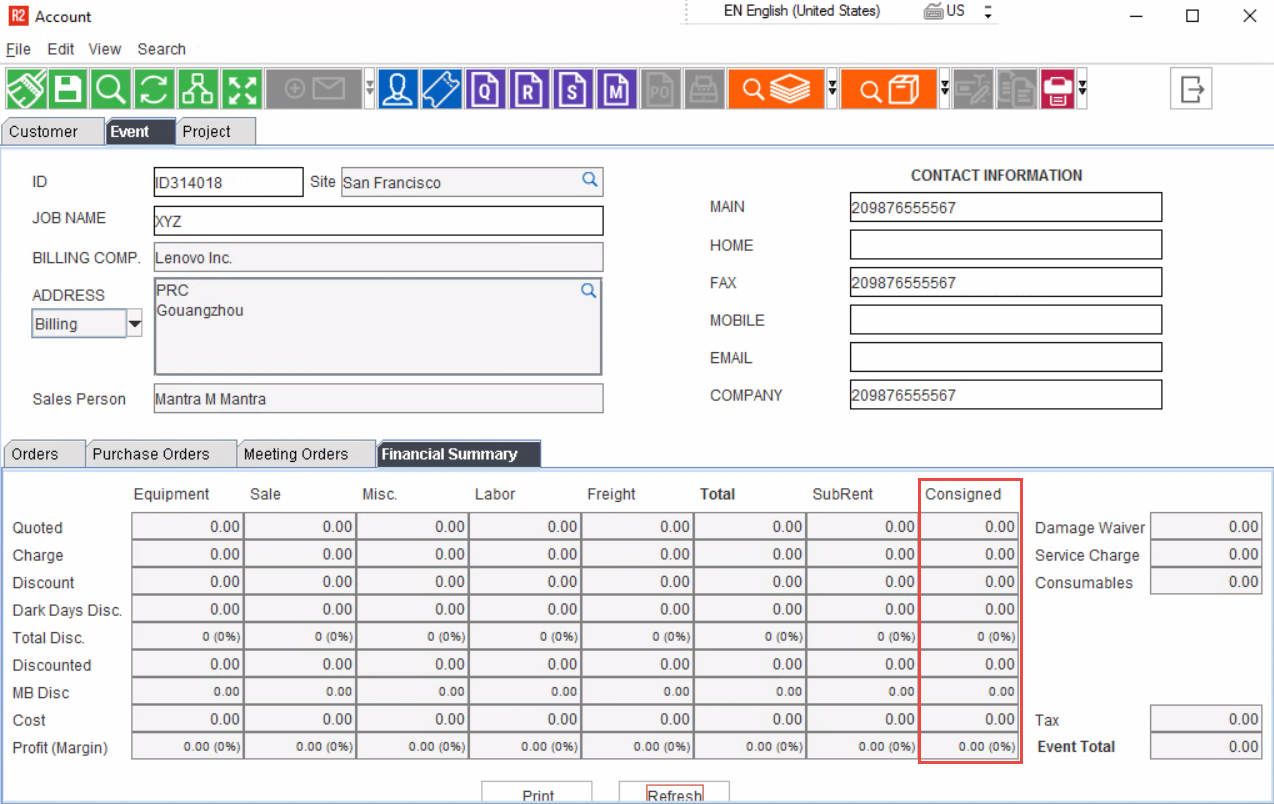

Consignor column is also added to show in the Accounts > Event > Financial Summary screen

Sale Order and Work order are not considered for Consigned commission.

How Unit Cost is Calculated?

If Total cost is = 1000

If unit duration is | Charge duration | Unit cost |

|---|---|---|

Month | (Total line charge duration/28) 1.071429 | (Total cost/ Charge duration in months) 933.333 |

Week | (Total line charge duration/7) 4.285714 | (Total cost/ Charge duration in weeks) 233.333 |

Day | (Total line charge duration/1) 30 | (Total cost/ Charge duration in days) 33.333 |