Enable To Pay Due Deposit As Taxable, When The Order Is Taxable

Reference No: NEPNL-70

Version No: 06.01.03-00

Details

Previously, though the ‘Tax Applicable’ checkbox is selected in the Subtotal section of the Order, user has to manually select ‘Is Taxable’ checkbox in Pay Due Deposit screen. This manual selection was allowing users to do miscalculations, if they miss to select the checkbox.

In this enhancement, when the Order is taxable, by default system selects the ‘Is taxable’ checkbox in the Pay Due deposit screen. If required, it can be altered by user further.

However, it should be noted that any changes to Tax Applicable check box in Order Subtotal section does not affect the Is Taxable state of existing Deposits and vice versa.

Pre-requisites

Make sure Action on Deposits is set as None and Deposit Misc. is tagged in the Configuration Module > Accounting

Sample Workflow

Create an Order.

Enter Unit Price, Discount and tag the tax.

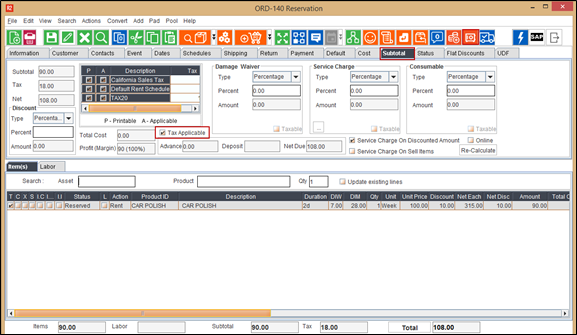

Make sure ‘Tax applicable’ field is selected in the Subtotal section.

In the menu bar, click Pay Due Deposit icon.

Figure 1.0: Click Pay Due Deposit Menu

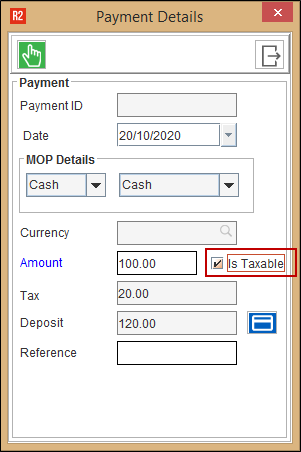

Click Add icon.

By default, ‘Is Taxable’ checkbox is selected when the ‘Tax Applicable’ field is selected in the subtotal section.

If the ‘Tax applicable’ checkbox is not selected in the subtotal section then by default, in the Pay Due Deposit screen ‘Is Taxable’ checkbox will be not selected.

Figure 2.0: By Default, Is Taxable Checkbox Is Enabled