Details About Adjusting Deposits Against Invoices

The posted Deposits made against an Order can be adjusted to one or more of its Invoices. The functionality is explained with a sample workflow.

Sample Work Flow

Create a periodic billing Rental Order [CO330160] for 3 months duration with Billing Terms set as Monthly.

Add an Item [LED37TV] to it with Unit Price as 10,000.00.

Tag a Tax Region [TAX#10] with tax percent as 10%. The Order's Total is now 33,000.00, inclusive of Tax.

Invoice the Order [CO330160]. Three invoices get generated [330206], [330215] and [330224], one for each month. Each will be for an amount of 11,000.00 (which is 10,000 + 1,000 tax).

Click

Pay Due Deposit icon (the icon will be enabled for Orders only if the Order is not in Done and Invoiced status). This displays the Deposit dialog box.

Pay Due Deposit icon (the icon will be enabled for Orders only if the Order is not in Done and Invoiced status). This displays the Deposit dialog box.Click

Add icon. This displays the Payment Details dialog box.

Add icon. This displays the Payment Details dialog box.Enter 7000.00 in the Amount field.

Select the Is Taxable check box. If this check box is selected, then the system will calculate tax for the amount entered in Amount field based on the Tax Region tagged to the Order, and will display it in Tax field. The deposit to be collected, inclusive of the Tax, will be displayed in Deposit field.

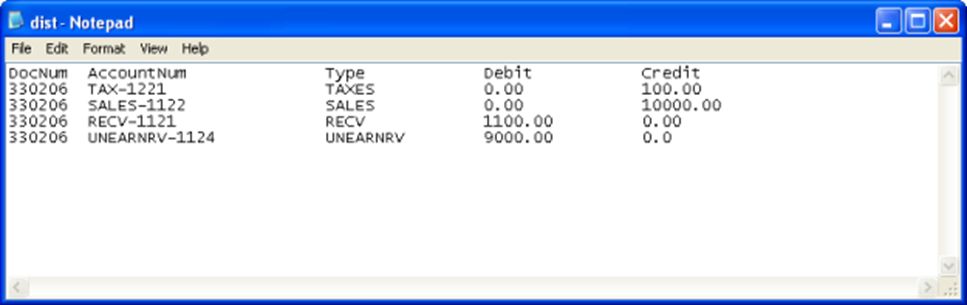

The tax amount will get calculated based on the Order's tax % (10% in this case) and will be displayed in Tax field as 700.00. The Deposit amount to be collected = Amount + Tax and will be displayed in Deposit field as 7700.00, as shown in Figure 1.0.

Figure 1.0 Adding Deposit using Payment Details Dialog Box

Notes:

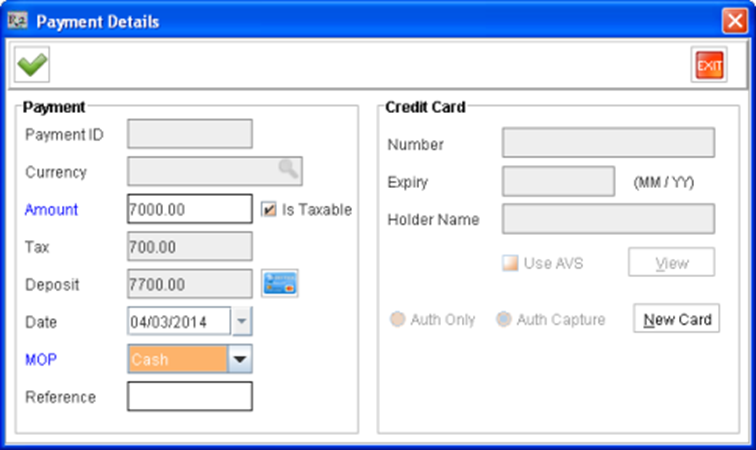

The Is Taxable check box in the Payment Details dialog box will be enabled only if following settings are done in Configuration module > Accounting tab, as shown in Figure 1.1:

The Action on Deposits field is set to None.

The Deposit Misc. field has a Deposit Misc. Charge tagged in it.

The Deposit Misc. field will be enabled and Misc Charge can be tagged only if Action on Deposits field is set to None.

Else the Is Taxable will be deselected and disabled in Payment Details dialog box.

Figure 1.1 Configuration Module > Accounting Tab Settings for Enabling Is Taxable Check Box in Payment Details Dialog Box

Click

OK icon. The deposit will get saved in the system.

OK icon. The deposit will get saved in the system.Add one more Deposit of value of 5500.00 (Deposit - 5000 + Tax - 100) for the same order [CO330160]. The added deposits will be listed in the Deposit window grid.

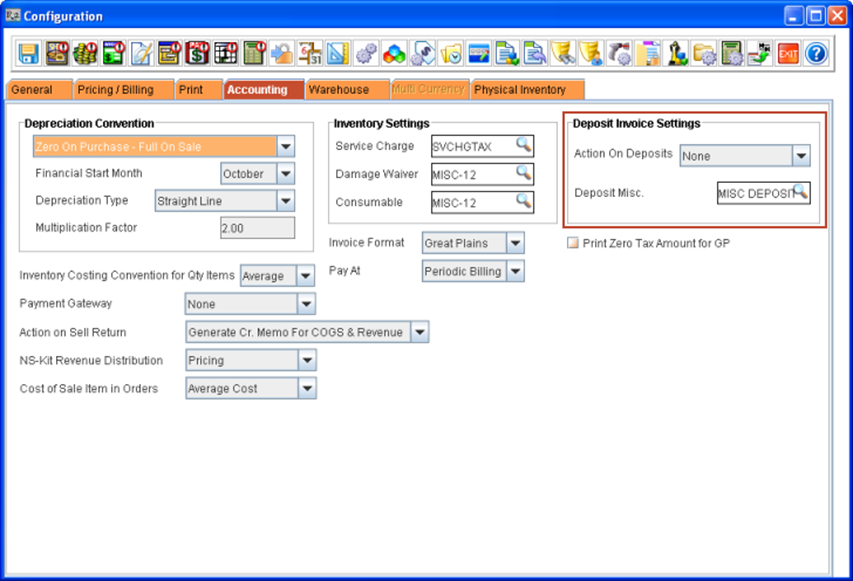

Adding Comments to Deposits

Comments can be added to Deposits made against an Order by selecting the Deposit line and clicking the Comment icon in the Deposit window, as shown in Figure below.

Figure - Adding Comment to Deposit

Printing Deposit Comments

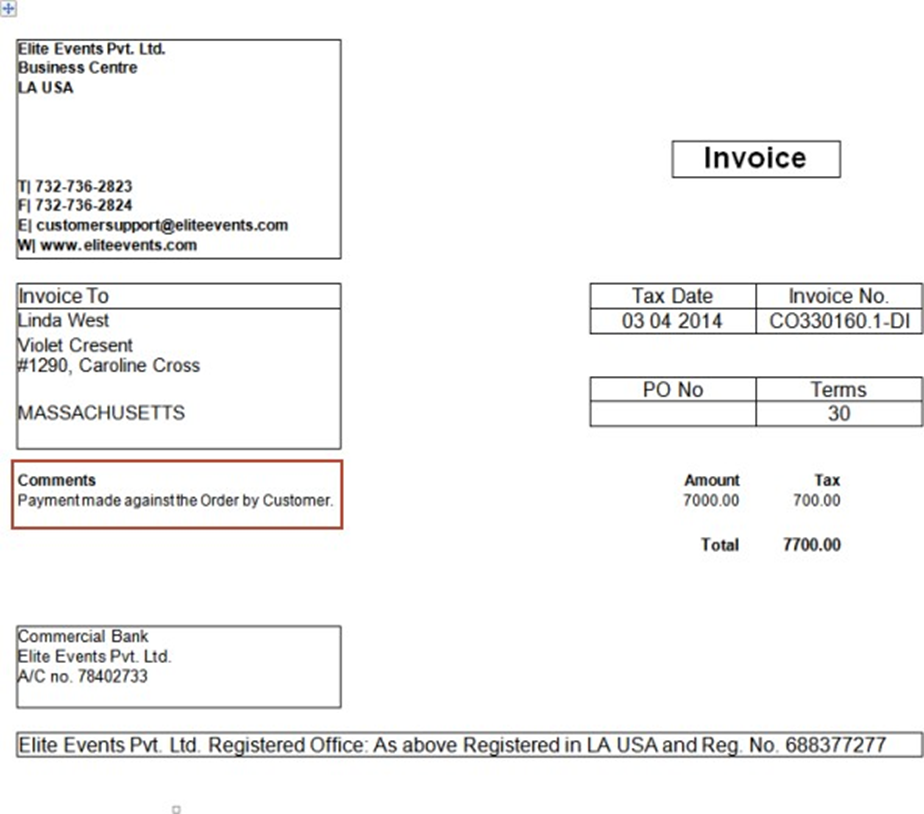

The comment(s) added to a Deposit can be printed in the Deposit's Invoice Print, as shown in Figure below. CID 540 has to be used in 159500UI for printing the Deposit Comments.

Figure - Deposit Comments printed in the Deposits' Invoice Print

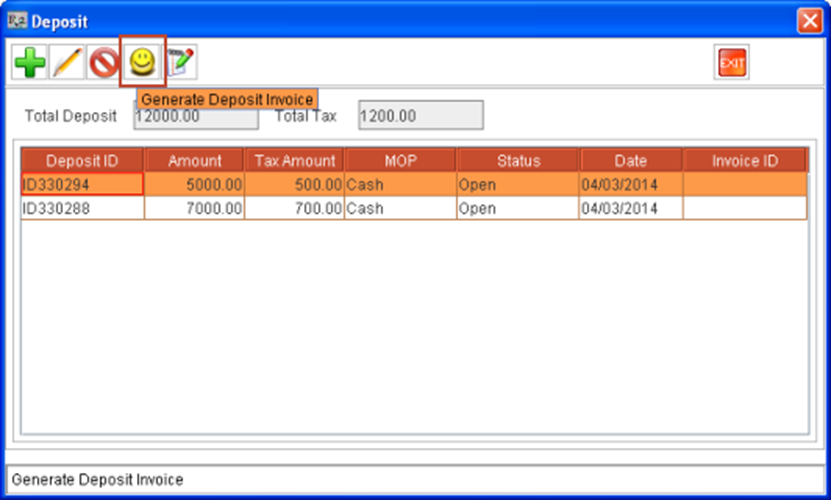

Select a Deposit line listed in the Deposit window grid and click Generate Deposit Invoice icon, as shown in Figure 1.2. This generates the Deposit’s Invoice with a temporary Invoice ID (Order ID suffixed with DI). Repeat this step and generate Invoice for both the Deposits listed in Deposit window.

Figure 1.2 Generating Deposit's Invoice from Deposit Window

Notes:

Un-posted Invoice can be made void by clicking the Void icon in the Deposit window.

The Generate Deposit Invoice icon in the Deposit window will be enabled only if following settings are done in Configuration module > Accounting tab, as shown in Figure 1.1:

The Action on Deposits field is set to None.

The Deposit Misc. field has a Deposit Misc. Charge tagged in it.

The Deposit Misc. field will be enabled and Misc Charge can be tagged only if Action on Deposits field is set to None.

Else the Generate Deposit Invoice icon will be disabled in Deposit window.

The Deposits’ Invoices get created as:

Deposit ID - ID330288 Deposit Invoice ID - CO330160.1-DI

Deposit ID - ID330294 Deposit Invoice ID - CO330160-DI

Notes:

On invoicing the deposits, temporary Invoice IDs (Order ID suffixed with DI) are generated. For Example, the first Deposit Invoice will be CO325186-DI, second Deposit Invoice will be CO325186.1-DI, third Deposit Invoice will be CO325186.2-DI and so on.

Permanent Invoice IDs, based on IDS, for the Deposits' Invoices are generated on posting the Deposits' Invoices.

On changing the Billing Customer or Main Customer, all un-posted invoices for the Order gets cleared.

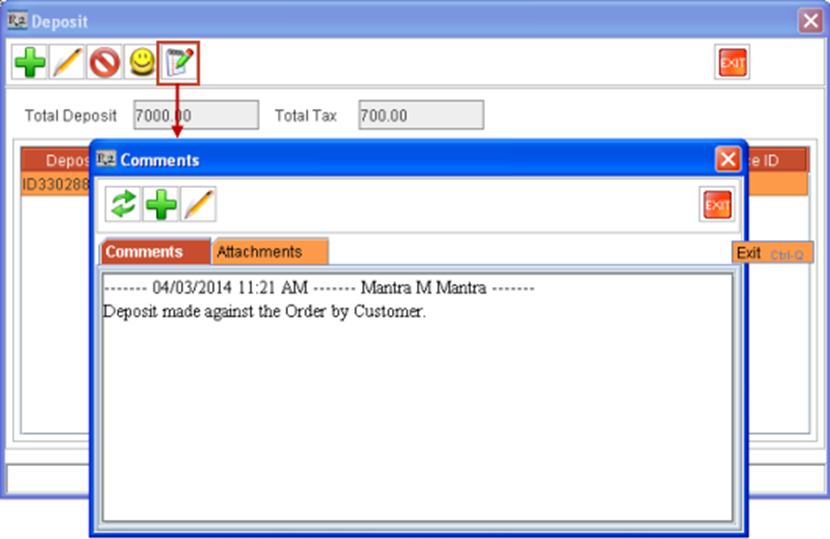

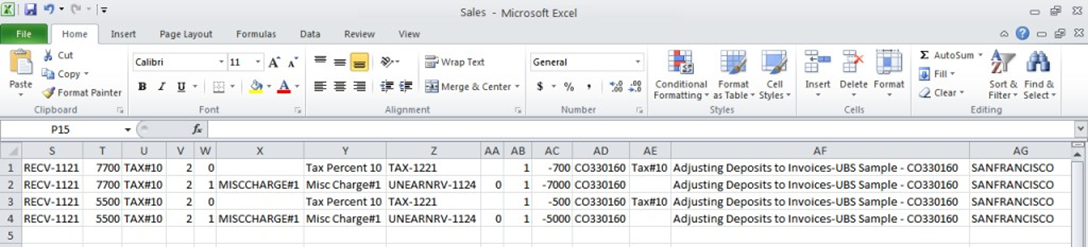

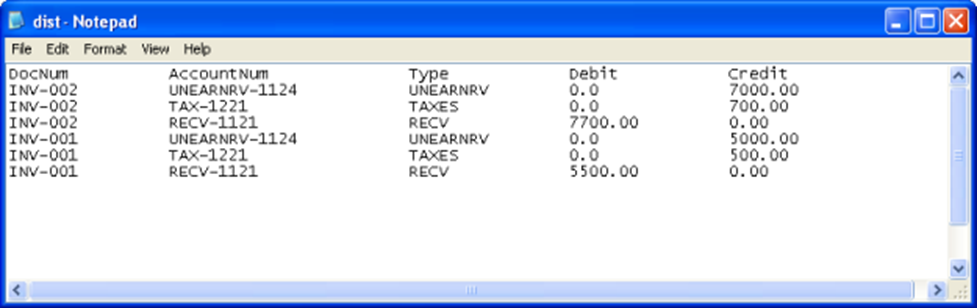

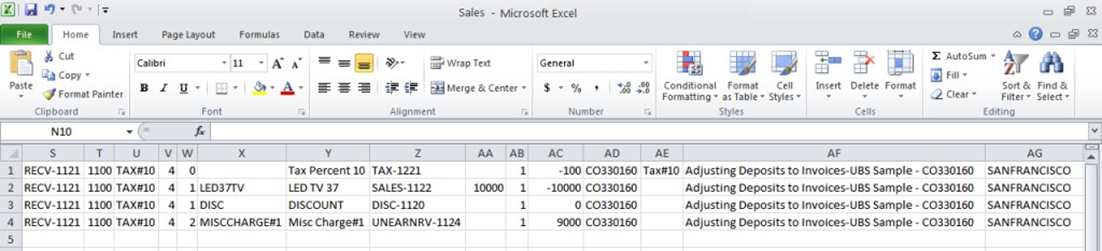

Add the Deposits' Invoices to an AR Batch and post it. On posting the Deposits' Invoices, the accounting entries will go, in Peachtree and Great Plains format, as shown in Figure 1.3 and Figure 1.4.

Figure 1.3 Sales.csv File generated on posting Deposits' Invoices for an Order in Peachtree Format

Figure 1.4 Dist.csv File generated on posting Deposits' Invoices for an Order in Great Plains Format

Notes:

As a prerequisite, GL Code setup has to be done in the system (from Invoicing module > Actions menu > GL Code) for the following GL Account types:

SALES

TAXES

RECEIVABLES

UNEARNRV

If a Liabilty GL Code is tagged to the Tax Schedule for the Tax Region tagged to the Order, then the Liability GL Code is considered as the Tax GL Code.

The Revenue GL Code tagged to the Deposit Misc Item is considered as the GL Code for UnEarnRev.

To adjust the paid deposit (fully or partially) against one or more of the Order’s invoices:

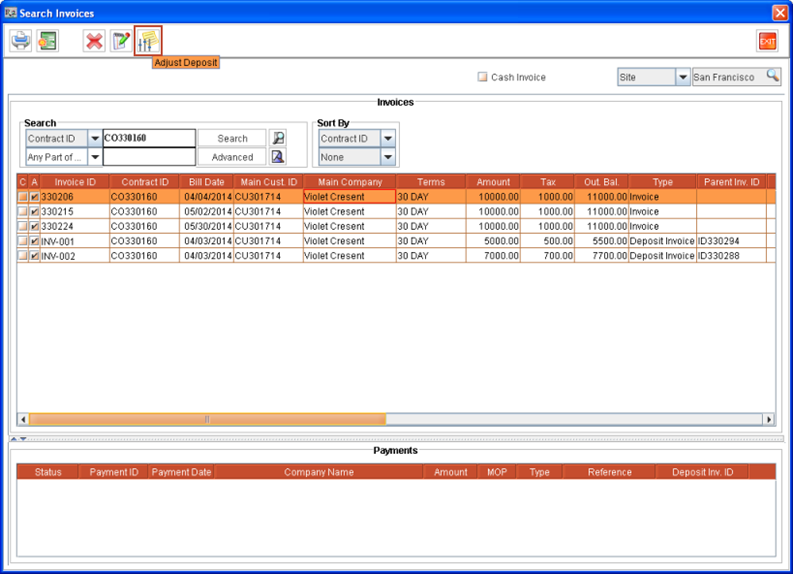

Select Account module main window > View menu > Invoices. This displays the Search Invoices window.

Search for the invoices of the Order [CO330160]. The 3 invoices of the order [CO330160] get listed in the Search Invoices window, as shown in Figure 1.4.

Notes:

While invoicing/re-generating Order Invoice, if un-adjusted Deposits are present for the Order, then the prompt message "Contract is Done and Invoice No. is < Invoice No.>. Do you want to adjust the deposits?" is displayed with Yes and No options. On clicking Yes, the Invoice List window is displayed, from where the Deposits can be adjusted to the Invoice(s).

Order Print can be generated from the Invoice List window by clicking the drop-down arrow on the Print icon .

Select a listed invoice line from the Search Invoices window and click the Adjust Deposit icon.

Figure 1.5 Selecting an Invoice line and clicking Adjust Deposit icon from Search Invoices Window

Notes:

The Adjust Deposit icon in the Search Invoices window will be enabled only if following settings are done in Configuration module > Accounting tab, as shown in Figure 1.1:

The Action on Deposits field is set to None.

The Deposit Misc. field has a Deposit Misc. Charge tagged in it.

The Deposit Misc. field will be enabled and Misc Charge can be tagged only if Action on Deposits field is set to None.

Else the Adjust Deposit icon will be disabled in Search Invoices window.

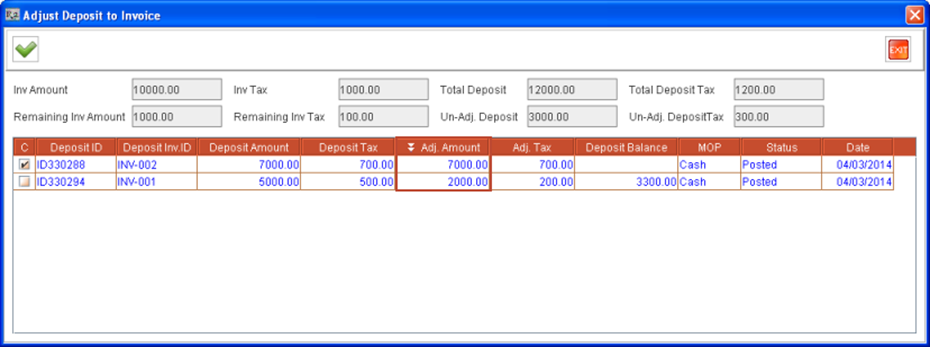

This displays the Adjust Deposit to Invoice window listing the Order's deposits. Enter the amount to be adjusted from a listed deposit to the invoice against it under the Adj. Amount column, as shown in Figure 1.6.

Figure 1.6 Two Deposits - One being fully and other partially adjusted against an Invoice

Note: The deposit amount can be adjusted to an Invoice to the maximum of the Invoice Amount. The Remaining Invoice Amount for an invoice can be zero but cannot be a negative number.

The entered amount will be reduced from invoice's amount. The following fields in this window gets automatically refreshed based on the amount entered in the Adj. Amount column:

Remaining Inv. Amount - Displays the remaining Invoice amount against which deposits can be adjusted. The Total Invoice Amount for the selected Invoice is displayed in Inv Amount field.

Remaining Inv. Tax - Displays the remaining Invoice Tax amount against which deposits tax can be adjusted. The Total Invoice Tax Amount for the selected Invoice is displayed in Inv Tax field.

Un-Adj Deposit - Displays the remaining Deposit amount which has to be adjusted against Invoices. The sum Total of all Deposits posted for this Order is displayed in Total Deposit field.

Un-Adj Deposit Tax - Displays the remaining Deposit Tax amount which has to be adjusted against Invoices. The sum Total of all posted Deposits Taxes for this Order is displayed in Total Deposit Tax field.

Adj. Tax column in grid - This calculates and displays the Tax adjusted for the deposit based on the Order’s tax percent and the entered amount in Adj. Amount column.

Deposit Balance - This calculates and displays the balance remaining for this Deposit that needs to be adjusted against Order's invoices. This is calculated based on the entered Adj. Amount. This is calculated as:

(A Deposit's Amount - The Deposit's Amount already adjusted) + (The Deposit's Tax - The Deposit's Tax already adjusted).

The tax will also get calculated for the adjusted amount (based on the Order’s tax percent in this case at 10%) and will get adjusted against the invoice's tax amount.

For example, in this case the following amounts get adjusted against the selected invoice [330206] (after selecting which the Adjust Deposit to Invoice window is opened):

Total Deposit amount is 13,200.00, out of which 9000.00 (7000.00 of first deposit [ID330288] + 2000.00 of second deposit [ID330294]) get adjusted against Invoice Amount of 10000.00, making Remaining Invoice Amount as 1000.00 and Un-Adj Deposit amount as 3000.00.

Total Deposit Tax is 1200.00, out of which 900.00 (which is 10% of the deposit adjusted amount) get adjusted against Invoice Tax amount of 1000.00, making Remaining Invoice Tax as 100.00 and Un-Adj Deposit Tax amount as 300.00.

Click the OK icon once all deposits adjustments are made to the invoice. This will close the Adjust Deposit to Invoice window and will return to the Deposit dialog box.

The information regarding the Deposits adjusted to the invoice(s) can be included in the Invoice print. The CIDs used and the information it prints are given below:

5600 - Adjusted Deposit amount to the invoice (excluding tax).

5601 - Adjusted deposit tax to the invoice.

5602 - Total Adjusted deposit amount to the invoice (Adjusted deposit amount + Adjusted deposit tax).

5603 - Invoice Due after adjusting deposit including tax (total invoice net amount including tax - total adjusted deposit amount to the invoice including tax).

5604 - Invoice Due amount after adjusting deposit excluding tax (total invoice net amount excluding tax - total adjusted deposit amount to the invoice excluding tax).

5605 - Balance Invoice Tax after adjusting deposit (total invoice tax - total adjusted deposit tax to the invoice).

On posting an invoice of the Order with deposit adjustments made against it, the accounting entries will go in Peachtree and Great Plains format, as shown in Figure 1.7 and Figure 1.8. This will have reversal entries for Deposit adjustments (made against the invoice), which were already posted.

Figure 1.7 Sales.csv file generated on posting an Invoice with Deposit Adjustments made against it - Peachtree Format

Figure 1.8 Dist.csv file generated on posting an Invoice with Deposit Adjustments made against it - Great Plains Format