Weekly Rental Breakup Printing on LOC Billing Orders with Grid Pricing at Header

Note: This feature is designed for a specific business use case and works as intended only when specific configuration settings are enabled. More details are as described.

Pre-requisites:

To use this feature, ensure the following are in place:

Enable Grid Pricing:

Navigate to Configuration > Apply Grid Pricing to Order and set the flag to True.

Set Grid Pricing on Order Header:

On the Defaults tab of the Order header, apply the Grid Pricing definition with the following settings:

Grid Mode: Percent

Mode Type: Cumulative

Unit: Week

Additional Backend Configuration:

This feature also requires backend settings that must be enabled via database scripts.

Please contact Professional Services to review your requirements, confirm suitability, and activate the necessary settings.

Grid Panel ID and CIDs must be configured to enable printing of Weekly Rental Amount breakdown on Order and Invoice prints using forms 153500UI and 159500UI.

Panel ID | CIDs | Description |

|---|---|---|

800003 | 603041 | Prints the Order Header Grid Pricing Schedule Unit. |

603042 | Prints the Order Header Grid Pricing Schedule Value. | |

603043 | Prints the Total Rental Amount of Each Grid Schedule on Order or Invoice. More details on how these values are printed are explained in the below sections. |

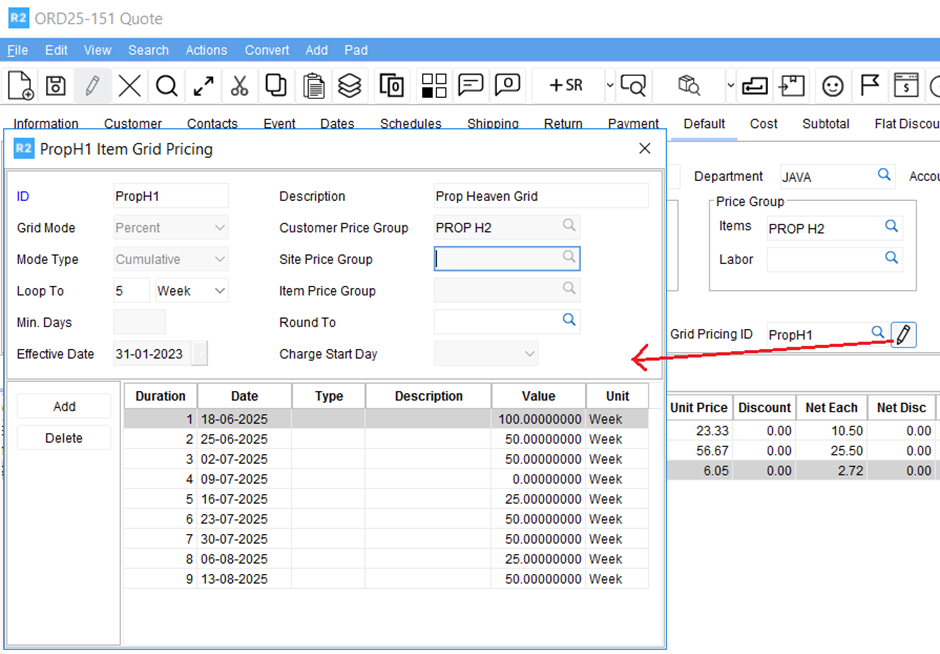

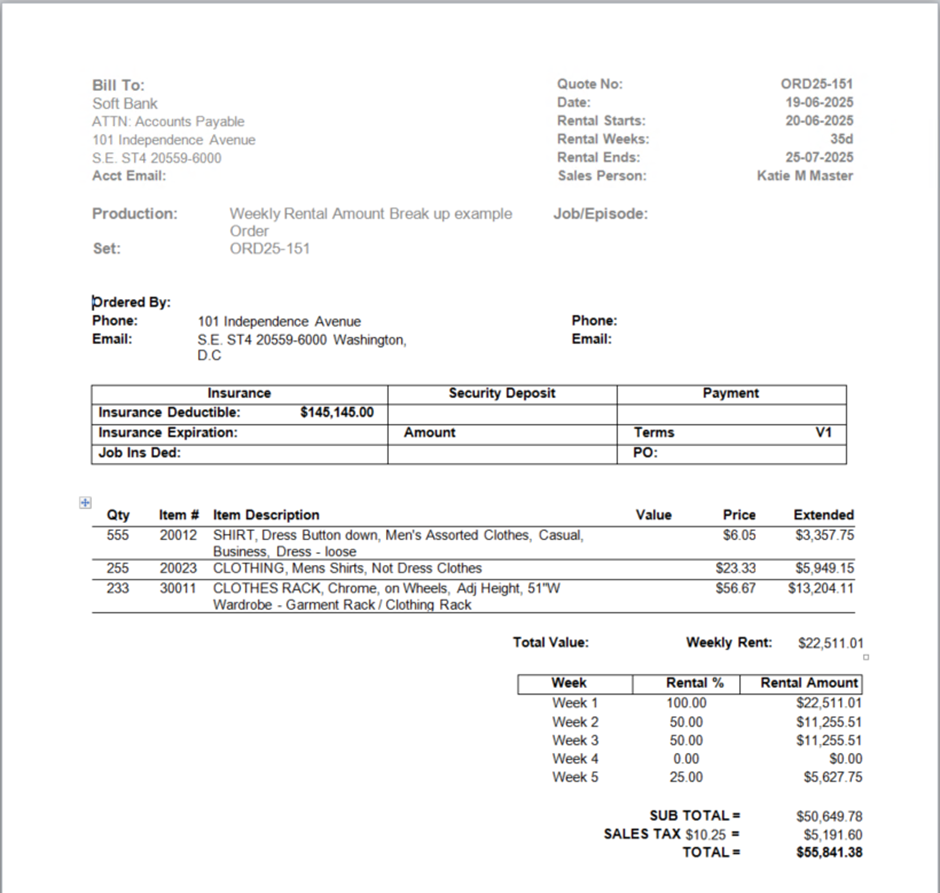

Sample Print:

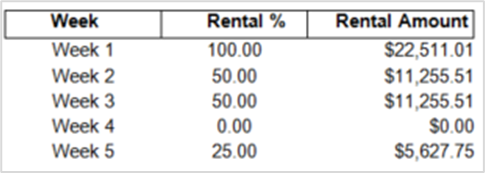

Figure 1.0: Sample Print for above CID’s

Summary CIDs can be used along with Weekly Rental Amount Breakup (Panel ID: 800003)

You can use the below listed CIDs along with the Weekly Rental Amount breakup grid. These CIDs will work only when placed below the panel ID 800003. These can be used on Order as well as Invoice forms.

CIDs | Description |

|---|---|

100026 | Prints the Subtotal i.e., Sum of Rental Amount printed by CID 603043 of Weekly Rental Amount breakup (800003) panel. |

100028 | Prints Tax, i.e., Order Tax Schedule %s applied on Subtotal printed by CID 100026. |

100027 | Prints the cumulated Tax % of Tax Schedules applied on the Order/Invoice. |

For printing Total i.e., Subtotal (i.e., Value of CID 100026) + Tax on Subtotal (i.e., Value of CID 100028), use Component Type in 5th field as 116 and in 39 column, specify the parameter value as “CID_MATH_EXPRESSION=${CID=100026} + ${CID=100027}”  | |

Sample Print:

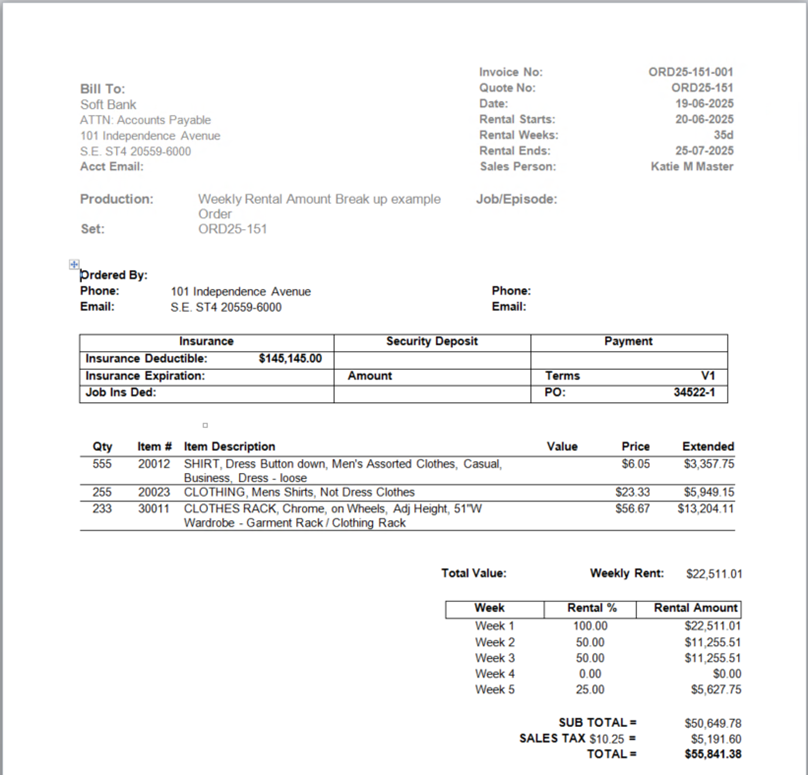

Figure 1.2: Sample Print for above CID’s

Sample Workflow

Below workflow explains how the above said Panels and CIDs can be used and how it works.

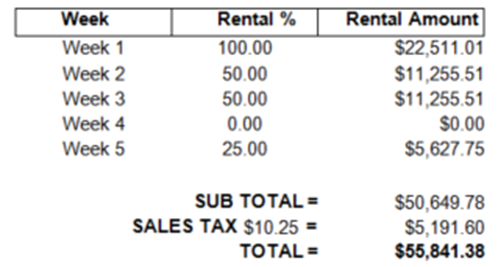

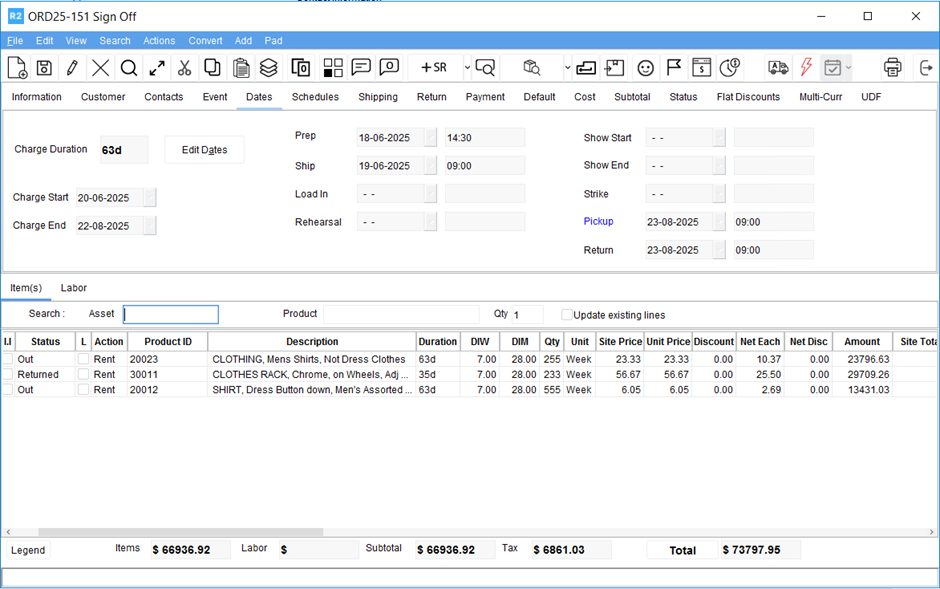

Create an Order for 5-week duration with Pay At as Periodic Billing and Billing Terms with LOC – Out & Returned and with Items and Prices as below:

Figure 2.0: Order for 5-week duration with Pay At as Periodic Billing and Billing Terms with LOC – Out & Returned

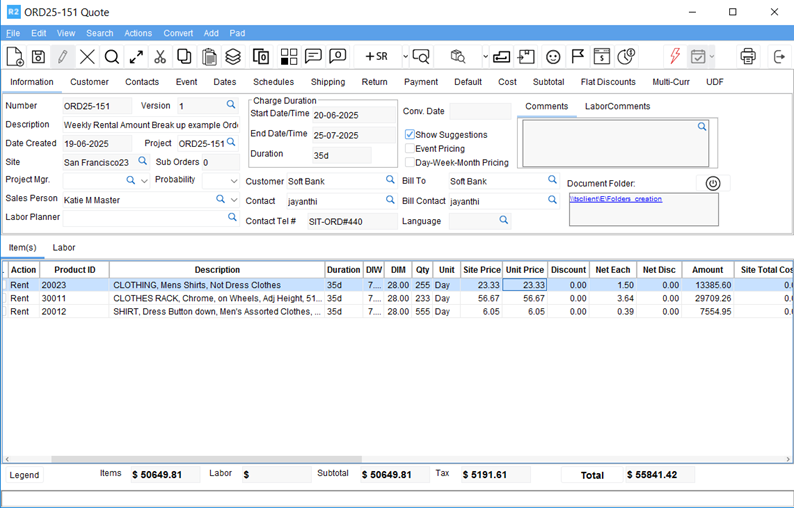

This Order has Grid Pricing applied at Order level as below:

Figure 2.1: Grid Pricing applied at Order level

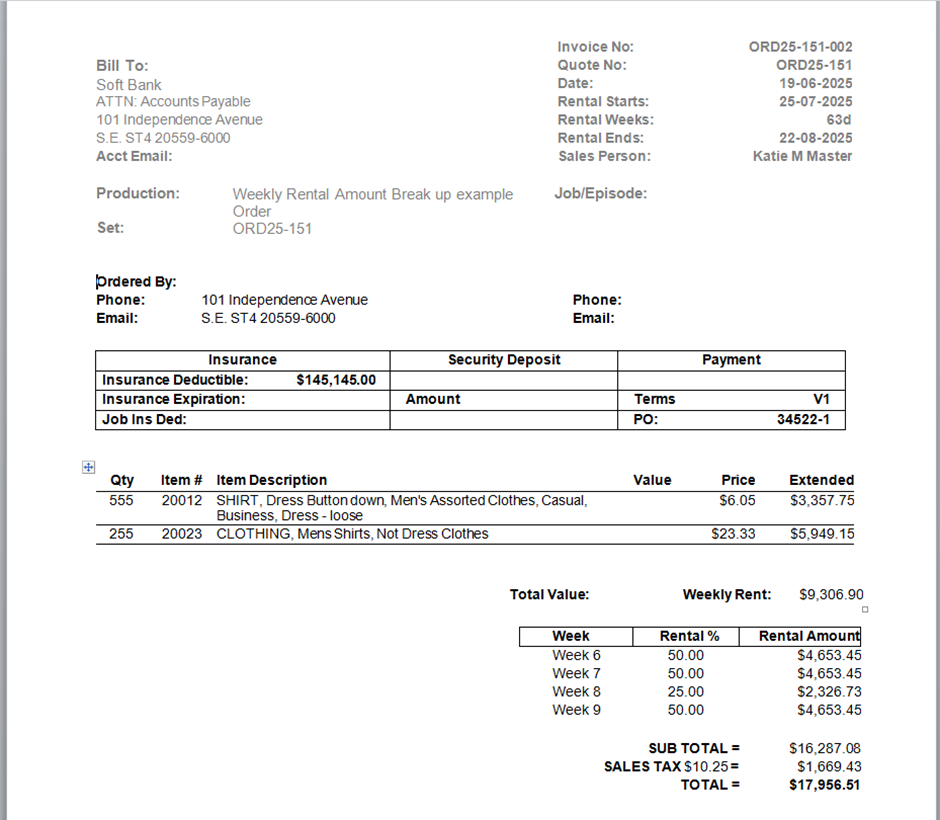

Print the Quote using 153500UI which has the above said panel and CIDs. The print generated will show the Weekly Rental Amount break up along with subtotal, tax and total as below:

Figure 2.2: Print the Quote using 153500UI

Here is how the Weekly Rental Amount break up for each week is calculated:

The values printed by the above said CIDs are computed values and are computed as explained below:

Weekly Rent of Order when charged at 100 % of per week unit price = Item#1.Qty x Item#1.Unit Price + Item#2.Qty x Item#2.Unit Price + Item#3.Qty x Item#3.Unit Price + …..

i.e., For the above said order Weekly Rent will be: 555 x 6.05 + 255 x 23.33 + 233 x 56.67 = 22,511.01

The Grid Pricing attached to the order is as below:

Week 1 - 100 %, Week 2 - 50 %, Week 3 - 50 %, Week 4 - 0 %, Week 5 - 25 %

Hence, Rental Amount printed on the Weekly Rental Amount breakup grid will be calculated as:

Week | Rental % | Rental Amount |

Week 1 | 100 | 22,511.01 (100 % of 22,511.01) |

Week 2 | 50 | 11,255.51 (50 % of 22,511.01) |

Week 3 | 50 | 11,255.51 (50 % of 22,511.01) |

Week 4 | 0 | 0.00 (0 % of 22,511.01) |

Week 5 | 25 | 5,627.75 (25 % of 22,511.01) |

Subtotal printed by CID 100026 = 22,511.01 + 11,255.51 + 11,255.51 + 0.00 + 5,627.75 = 50,649.78

Tax printed by CID 100026 (At 10.25% schedule applied on Order) = 10.25 % of 50,649.78 = 5,191.60

Sum of Printed Subtotal + Printed Tax (using CID combo) = 55,841.38

Variance between values shown on print vs. application interface:

Below section explains the possibility of R2 interface showing different values than what is printed by the above CIDs.

The values printed by the above grid panel and CIDs are calculated while printing at run time and are according to what the renting company wants to bill its customer. Note that there could be a variance by few pennies between these printed values and what R2 calculates and persists on the system. This can particularly happen when the unit prices are defined in fractions and more quantities are added on order that leads to third decimal weekly rental amount. Below section explains the same for the above said order.

R2 calculates the totals for each item level for all 5 weeks and then sums each items total to arrive at the subtotal:

Week1 | Week2 | Week3 | Week4 | Week5 | Total |

5949.15 | 2974.58 | 2974.58 | 0 | 1487.29 | 13385.60 |

13204.11 | 6602.06 | 6602.06 | 0 | 3301.03 | 29709.26 |

3357.75 | 1678.88 | 1678.88 | 0 | 839.44 | 7554.95 |

| R2's Value | Printed Value | Variance (R2’s Value – Printed Value |

Subtotal | 50649.81 | 50,649.78 | -0.03 |

Tax at 10.25% | 5191.61 | 5,191.60 | -0.01 |

Total | 55841.42 | 55,841.38 | -0.04 |

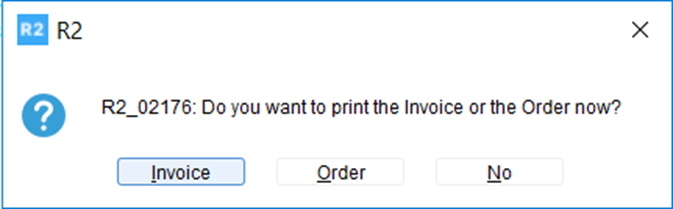

Continue the above workflow. Convert the Order to Reservation, Dispatch the Items and click Happy Face(

) to Invoice the Order. It will prompt for printing the Invoice or Order, and choose to print the Invoice.

) to Invoice the Order. It will prompt for printing the Invoice or Order, and choose to print the Invoice.

It will print the generated Invoice as below. The printed output will be similar to Order print, since it would have included all the items on the order for 5 Weeks into single Invoice.

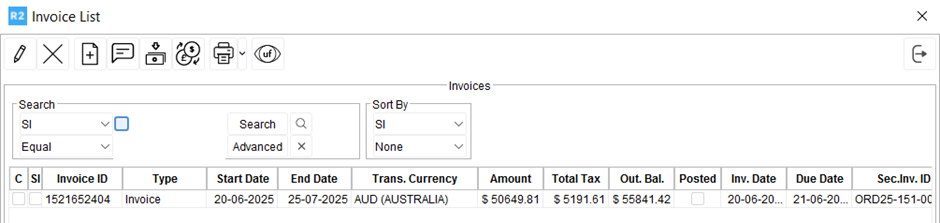

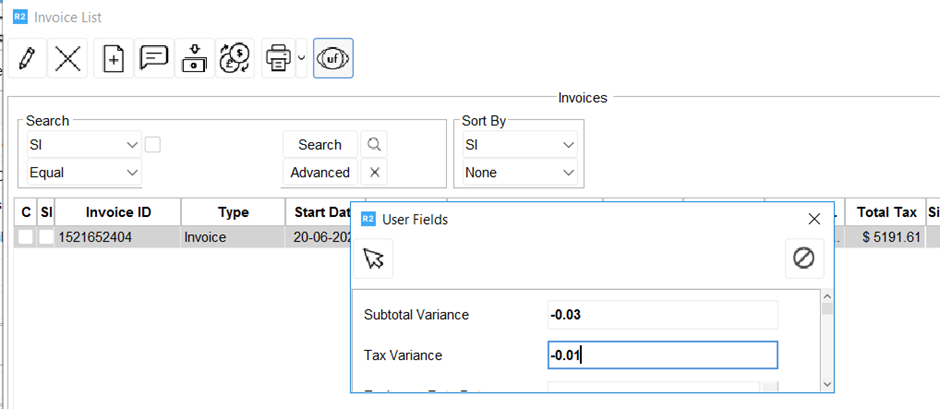

The calculations of the printed values are same as what is explained above for order print. There will be a variance between what is printed on Invoice print and shown in the application Invoice record, for the same reason explained for Order print. Here is the screen shot of the Invoice values from R2.

After printing the invoice successfully, system will write the Subtotal Variance and Tax Variance values between the printed values and application values into the user defined fields of the respective invoice whose names are Subtotal Variance and Tax Variance with data type is Number. Usage of these UDF values is explained in the below sections.

Note: When the R2 values > printed values, UDF values will be shown in -ve. When the R2 values < printed values, UDF values will be shown in -ve.

Post the Invoice generated in Quick Books (Peachtree in R2) format and import it into Quick Books accounting tool.

After integrating such invoice into accounting tool, you should adjust the variance values stored on UDF fields (mentioned above) on the accounting package to match the invoice totals on accounting system with the values that have been charged to customer (as presented on the invoice print, which are nothing but the true revenue).Adjust as Discount, if R2 values > printed values

Adjust as an Additional Charge, if R2 values < printed values

After 5 weeks, return one of the items.

Extend the charge duration of the other two items to 9 weeks, as customer wants to continue to use those two items for next 4 weeks. Make sure you extend the Return Date as well as Charge Duration from Order Header and skip returned lines and update other lines. Updating Charge Duration from Order header is important for the weekly rental break up grid to print the values as required.

Happy face(

)the Order again and choose to print the Invoice on the prompt displayed. It will print the additional invoice that will be generated for the extended period of the two items which are still Out.

)the Order again and choose to print the Invoice on the prompt displayed. It will print the additional invoice that will be generated for the extended period of the two items which are still Out.

Note that the Total Weekly Rent of the order for this invoice period is only considering the two items i.e., 9,306.90. The Grid % from 6th week to 9th week will be applied on this value to arrive at the Weekly Rental Amount break up. The Subtotal, Tax and Total printed will be calculated as per the additional invoice. Same is explained as below:

Week | Rental % | Rental Amount |

Week 6 | 50 | 4,653.45 (50 % of 9,306.90) |

Week 7 | 50 | 4,653.45 (50 % of 9,306.90) |

Week 8 | 25 | 2,326.73 (25 % of 9,306.90) |

Week 9 | 50 | 4,653.45 (50 % of 9,306.90) |

Subtotal printed by CID 100026 = 4,653.45 + 4,653.45 + 2,326.73 + 5,627.75 = 16,287.08

Tax printed by CID 100026 (At 10.25% schedule applied on Order) = 10.25 % of 50,649.78 = 1,669.43

Sum of Printed Subtotal + Printed Tax (using CID combo) = 17,956.51

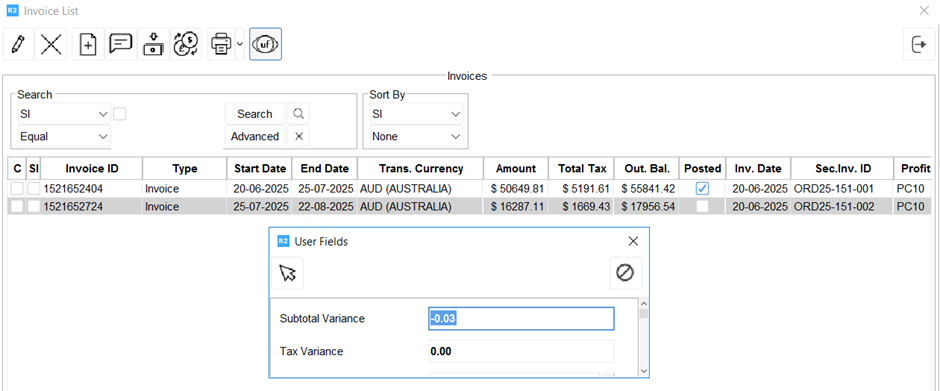

There would be a variance in this additional invoice also. Same will be recorded in the UDF fields as shown below. You should adjust these values in the accounting tool to match the actual revenue as explained in the previous steps.

Note: You may extract these Variance values stored on the Invoice UDF fields through an custom report created by using the REP_InvoiceUdfRepView.

Important!

The above explained solution of printing of the weekly rental amount distribution works as expected for Rental Orders only and it is to be understood that solution does not work when the following charges are used on the orders:

Discounts (at any level) would not give the math right. Hence, it is recommended to discount by reducing the Grid % in the Order header for the respective week.

Charges meant to be for one time and not be distributed for weeks.

Labor charges

Misc./Freight charges

Damage waiver

Service charges

Consumables

Sell items