Asset Detail - Depreciation

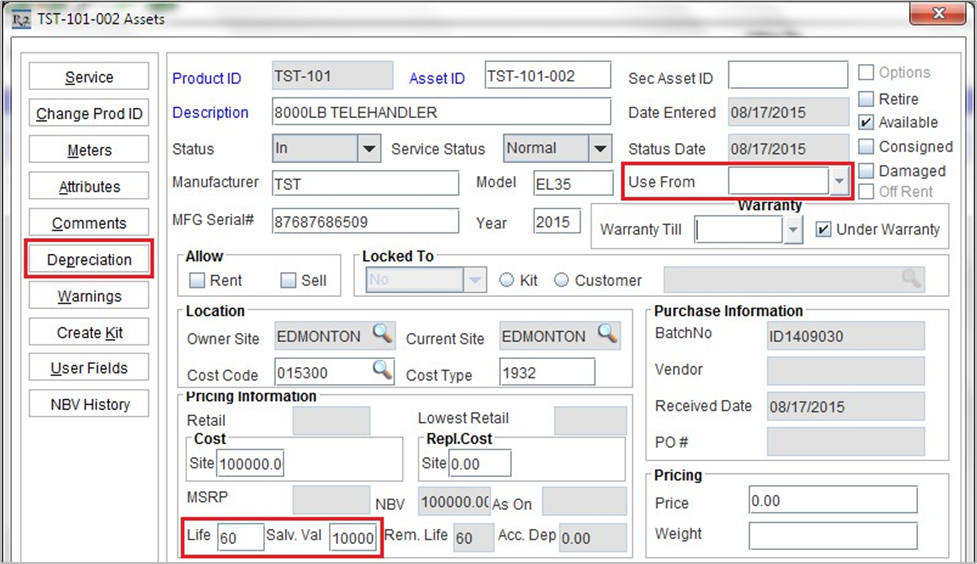

Upon editing the asset you can further manipulate the depreciation factors:

The Life and Salvage Value are editable fields in the event they need to be changed after receiving.

The Use From field acts as the Date Entered (or acquisition date) for depreciation purposes. If this is set, then the depreciation will be based from that date instead of the asset’s actual acquisition date.

Clicking the Depreciation button yields the depreciation schedule for the assets:

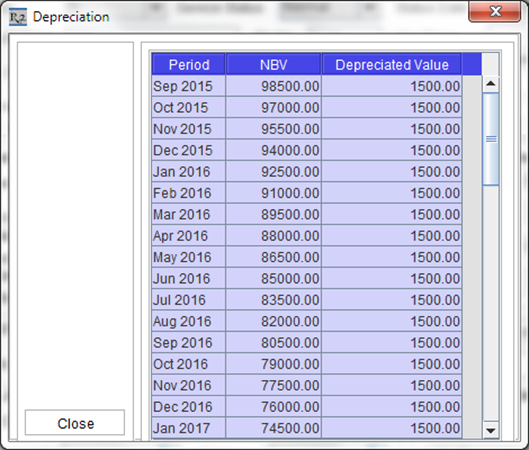

The first row here displays the first period of depreciation followed by what the NBV (Net Book Value) would be after the Depreciated Value has been subtracted.

In this example, the asset was received at $100,000, has a 60 month life (5 years), and a $10,000 salvage value. Therefore the monthly calculation is derived by:

Asset Purchase Cost – Asset Salvage Value / Life in Months

or

($100,000 – $10,000) / 60 =$1,500month depreciation

Posting Depreciation in R2

Posting Depreciation

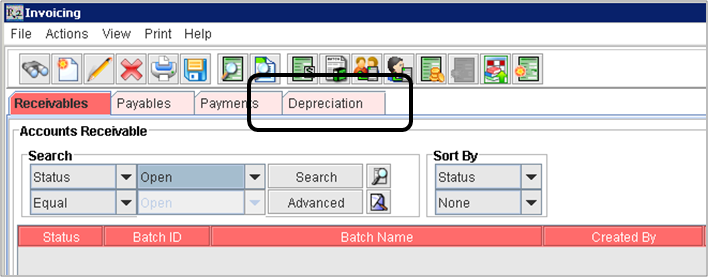

Begin in the INVOICING module from the R2 Launch Pad.

Click on the DEPRECIATION page.

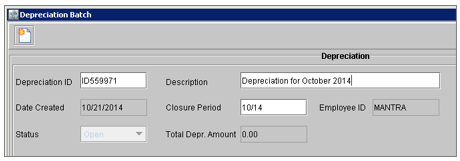

Click on the NEW icon ![]() , this will create a new batch.

, this will create a new batch.

Provide a descriptive “Batch Name” and enter the “Closure Period”. The Closure Period is the cut-off date, after which, R2 will not export depreciation on equipment. That is to say, if you enter 10/14 then R2 will post all unposted depreciation through the end of October 2014.

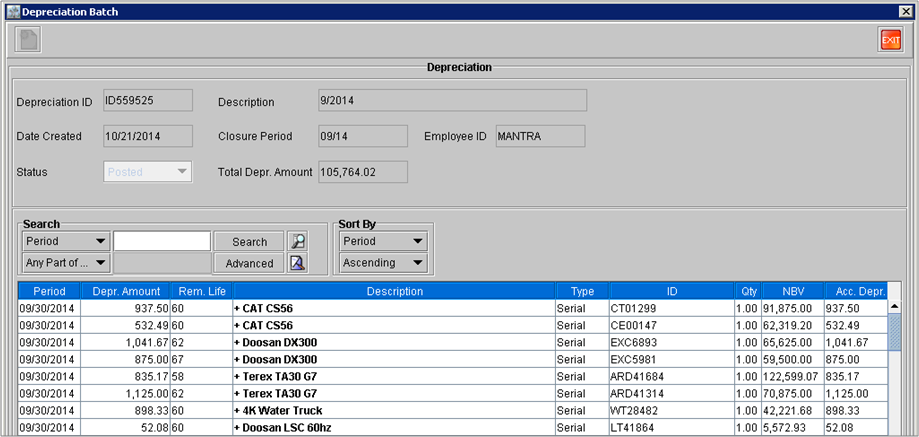

Once inside the batch, click on the Add Assets ![]() icon . All assets posting depreciation for the period(s) entered will appear toward the bottom portion of the batch screen (see below.)

icon . All assets posting depreciation for the period(s) entered will appear toward the bottom portion of the batch screen (see below.)

NOTE: if you have never batched depreciation from R2, the initial batch may be quite large (as it could contain past months of unposted depreciation). It is advised you break this into smaller, manageable chunks by using the “Closure Period”, or month.