Resale Certificates

Introduction

A Resale Certificate is a document issued by tax authorities that allows businesses to get tax exemption while purchasing/renting goods that they intend to put for resale/re-renting later.

However, the business is expected to collect tax from the end-user at the time of resale/re-renting.

Let's begin by exploring the following:

Navigation to Resale Certificates option

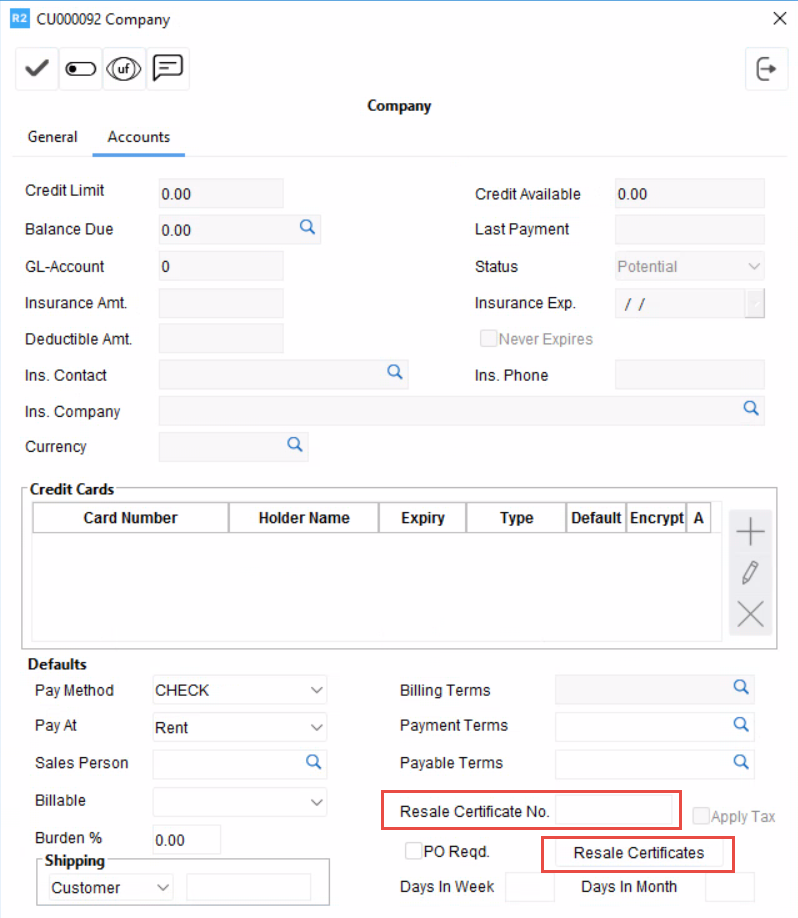

Go to R2 > Maintenance module > Customer > Company Edit > Accounts Tab.

Figure: 1.0 Resale Certificaes

There are two fields of Resale certificate number under Defaults section.

Resale Certificate No. (Free form field): This field allows you to directly input the Resale Certificate number which will then be automatically applied to all orders created for a company. Once the Certificate number is entered, ‘Apply Tax' check box is enabled (check box is next to Resale Certificate Number field as shown in above figure: 1.0). Having ‘Apply Tax’ not selected will make the orders as Tax not applicable. By selecting this checkbox, you can apply tax to the order even if a resale certificate is used.

Resale Certificates (Button): This option allows you to define state-wise resale certificates for a company. Know more?

When an order is created for a company, R2 will only consider the state-wise resale certificate if the ‘Resale Certificate No’ in the Company edit > Accounts tab is not provided.

Resale Certificates

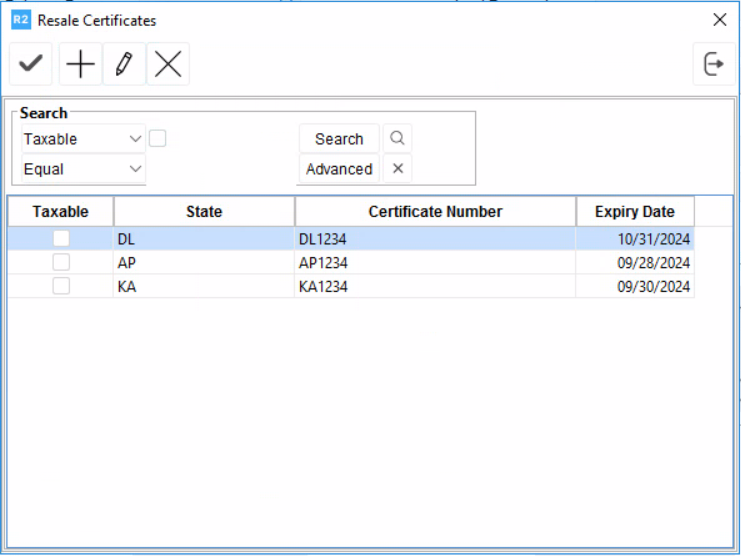

Here, you can specify state-specific resale certificates for a company, along with their expiration dates. These certificates help to ensure accurate tax collection on orders. With the help of expiry date, R2 automatically sets the appropriate certificate on orders and adjusts the ‘Tax Applicable’ status to True or False accordingly.

Fig: 1.1 Resale Certificates Window

Search: Search for a specific certificate from the list using the available criteria.

Resale Certificates list: All the certificates created so far displays here.

Add Resale Certificate

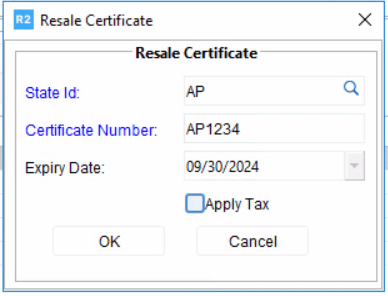

Click ‘Add’ button to open the ‘Resale Certificate’ dialog box.

Fig: 1.2 Adding a Resale Certificate

In the ‘Resale Certificate’ dialog box,

State ID: Click Importable icon, select the required state from the pre-defined list. This state refers to Ship to address state of the order.

Certificate Number: Enter the valid certificate number issued by the tax authorities for the respective state. This Certificate number will be populated on Order according to the applicability.

Expiry Date: Provide the Expiry date issued for the respective certificate. This defines when the particular certificate expires.

If the ‘Expiry Date’ is left blank, it means that the certificate never expires.

You can have only one unique certificate for a particular ‘State ID’ and ‘Expiry Date’ combination.

Note: Expiry Date is also included for the Resale Certificates Data Conversion. For more details, refer DataConversion.doc.The Certificate on the order sets according to the applicability of the certificate for the Order Prep date.

Apply Tax: By selecting or deselecting this checkbox, you can apply tax / not apply tax to the order if resale certificate is used.

Click Ok to save. To know how Resale Certificates consumed on Orders click here.

Each Customer can have multiple certificates with different Expiry Date per State.

Edit Resale Certificates

Select one of the certificates from the list.

Click ‘Edit’ button.

Modify the required values and click ‘Ok’ to save.

Delete an existing Resale Certificate

Select the desired certificate from the list and click the ‘Delete’ button.